No matter what size your group is, Blue Shield of California offers you flexibility in plan building and nimble, responsive account management. Your members can expect one-stop service and a great experience that proactively engages them in their health journey.

Coverage Solutions: THE BLUE SHIELD DIFFERENCE

All Blue Shield plans provide nationwide coverage; we tap into the same network of providers as other Blue plans across the country.

Discover flexible plans, high-touch account management, and increased employee engagement.

Large groups (101+)

A wide range of HMO, PPO, and other plan options help you manage costs while offering benefits that attract talent to your company. And both local and nationwide coverage ensures your employees have access to health care wherever they live or work.

Explore large group coverage

Discover Virtual Blue

A virtual-first plan available to all fully insured and self-funded employers. $0 unlimited virtual visits, including mental health & specialty care, provided by AccoladeCare. In-person care available through our California and nationwide PPO networks (cost share applies).

Explore Virtual Blue

Small businesses (1 - 100)

Various options combine high-value coverage and simple administration for small businesses.

Explore small business coverage

Group Medicare

If your company offers retiree coverage, learn about our high-value Medicare continuity of coverage options.

Labor & Trust

Labor & Trust industries often have highly specific needs. We have extensive experience in building plans to address those needs.

Explore Labor & Trust

Have a question? Speak to one of our representatives to find the plan best suited for you.

A new plan.

Made for your employees,

made for you.

Today, employees expect more. Virtual Blue delivers with anytime, anywhere virtual care, $0 copays for AccoladeCare virtual visits, and in-person care when they want it. A collaborative approach to care delivers better outcomes and elevates employee satisfaction, driving value for businesses of all sizes.

Collaborative approach to care integrating primary, behavioral health, and specialty care

A personalized experience with a dedicated virtual care team for each employee

Easy access to care via our California and nationwide PPO networks.

The Virtual Blue plan is available to all fully insured groups and self-funded employers. It is also available with BlueHPN EPO and a Personal Savings plan.

Trio HMO: Value-based care network

With Trio, employees have access to a select network of doctors, hospitals, and specialists committed to delivering a better healthcare experience. Trio’s accountable care organization (ACO) model ensures care is coordinated efficiently and member premiums remain low.

•24,000+ doctors and specialists and over 340 hospitals

•Broad California coverage with 78% of all zip codes and nearly 100% coverage in metropolitan areas

•$0 copay for virtual care from Teladoc® providers (including mental health care)

•Shield Concierge for personalized support for all aspects of care

•Wellvolution® lifestyle-based tools and support to lose weight, treat diabetes, support mental health, and more

Explore the Trio Network

Tandem PPO: Flexibility and choice at the right price

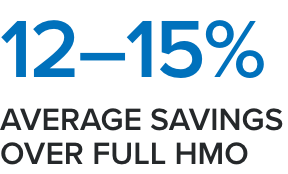

Like other PPO plans, Tandem PPO offers employees the freedom to choose any doctor or specialist in or out of the network ― but at a more affordable price. Tandem is a targeted PPO delivering extra savings and benefits.

•80,000+ doctors in the Tandem PPO network

•23 counties with 100% full PPO network match

•Preventive care services such as a flu shot are fully covered within the network

•$0 copay for virtual care from Teladoc® providers (including mental health care)

•Shield Concierge for personalized support for all aspects of care

•Wellvolution® lifestyle-based tools and support to lose weight, treat diabetes, support mental health, and more

Explore the Tandem PPO Network

Shield Concierge: High-touch services made personal

Shield Concierge service is included with Trio HMO and Tandem PPO plans. This personal, high-touch service gives employees a one-call source for answers. For employers, Shield Concierge helps reduce administrative responsibilities and improve employee satisfaction with benefits. •Dedicated customer service that includes claims and coverage experts, nurses, pharmacy technicians, and social workers

•A single point of contact with high-quality interactions designed to resolve member issues in the first call

•90% member satisfaction rating, with 92% of all calls resolved within 30 seconds

- ShowHide Transcript

Paula Lunde ( 00:08 ):

Healthcare can be scary and it could also be complicated. We help members navigate a system that isn't always easy to best meet their needs. Shield Concierge is one of our premium care models at Blue Shield where we pair a designated customer care team with a designated clinical team, and they're working in lockstep to really deliver customized solutions for our clients. It's all about resolving a member's issues in one call and then working as a team to make sure that the member gets what they need.

Cleo Mutebi ( 00:40 ):

This holistic approach really produces great patient healthcare outcomes. You have people with different expertise that can address every aspect of what the member's going through.

Sabina Rosenstock ( 00:52 ):

Maybe they need some assistance with a support group or personal therapist or psychiatrist.

Cleo Mutebi ( 00:57 ):

It's really a white glove service where you don't have to do anything more than just make that one initial call.

Amy Togonon ( 01:03 ):

Calling other health plans, you get transferred from person to person to person, and sometimes at the end of the call you still don't get an answer. And it's different in Shield Concierge because you call in, you speak to a customer service representative, and they're going to handle your call from beginning to end. They're going to be the one to call the different departments for you to take care of your needs.

Sabina Rosenstock ( 01:23 ):

When we support our members, we do our best to send them as much information as we can to reduce any homework that they might need to do on their own.

Paula Lunde ( 01:31 ):

We offer a really robust suite of clinical solutions that employers can get all in one place, and it's really a great way for employers to attract their employees.

Sabina Rosenstock ( 01:41 ):

Blue Shield really cares about what their employees go through and how they feel, and the resources and benefits that they need to be able to do their job effectively so that we can help our members and the community.

Cleo Mutebi ( 01:52 ):

My favorite part of my job is the impact that I make on a daily basis within Shield Concierge. Being able to get on the call with a member and being able to address the concerns or barriers that they may be facing is extremely rewarding.

Paula Lunde ( 02:06 ):

We're proud of how our teams have really touched the lives of members and really improve the quality of life.

Self-funded/administrative services only (ASO) plans

Our self-funded plans offer flexibility, control, and programs that promote a better member experience and better outcomes. These include Connect, our high-touch member advocacy support service.

•Customizable plans with whole person coverage available (disease management, Rx, dental, vision)

•80,000+ providers in California; national coverage with our extensive BlueCard® PPO network

•Member advocacy and service model that engages employees in their own health—with performance guarantees to back it up

Pharmacy: Integrated coverage for better value and outcomes

Looking for a smarter way to manage prescription drug costs? Our custom strategies and innovative cost management programs are designed with the highest quality care for your employees in mind—and offer savings of $16-24 per member per month.

Learn more about Pharmacy

Effective cost management solutions

- Robust formulary management

- Tailored plans that deliver better care at a better price

- Strategic partnerships to drive down costs via new generic and specialty drug programs

Simpler administration for employers

- Flexible, one-stop benefits shopping

- Streamlined administration with pharmacy and medical combined

- A proactive account management team ready to help

A better experience for employees

- Access to 68,000+ pharmacies nationwide, including all major chains

- Improved outcomes with coordinated pharmacy and medical care

- A single source of support for member questions

Dental, vision, and life coverage

Our specialty coverage supports total health and well-being with robust dental, vision, and life insurance options.

Dental

Wide network access is tied to where your employees need care. With comprehensive coverage across California and nationwide, employees are covered where they live, work, and travel.

Vision

Vision is one of the most popular voluntary benefits among employees. The largest vision network of doctors and specialists nationwide, with retailers like Costco, LensCrafters, Target Optical, and Walmart.

Life

Life insurance can give employees added security and greater peace of mind. Plans include tailor-made options, affordable rates, and benefits like travel insurance employees can use today.